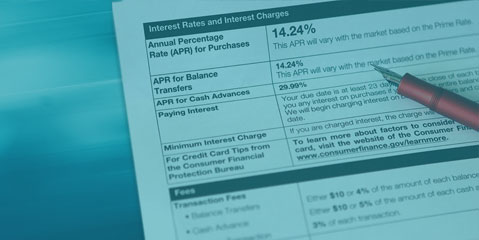

Managing disclosures and reducing risk are top priorities for banks, and both bring their fair share of pain points, especially during a year like 2022. First, there was the fast pace of digital transformation – to meet the post-COVID customer where they are, and to stay ahead of the fintech competition. On its heels was the head-spinning workload of marketing teams – to keep up with the Federal Reserve’s now four rate changes, and continue to get personalized offers out the door. And all this among increasing pressure to get disclosure management done well, done right, without errors or fines.

Risk reduction, regulations and rate changes have ruled the day – day after day, all year. The good news is that innovation, automation and regulatory compliance solutions are easier than ever to leverage.

Risk reduction, regulations and rate changes have ruled the day – day after day, all year. The good news is that innovation, automation and regulatory compliance solutions are easier than ever to leverage.

If misery loves company, we’ve been reassuring our clients that they are not alone. The laser focus on doing disclosures better is a common theme in the deep-dive discussions our platform solutions team members are having with their financial services partners over the past months.

This quick post offers immediate relief and resources to lighten the weighty responsibility of regulatory compliance.

For bank marketing teams, time is of the essence, faster is better, and process improvements are clearly the singular solution to thriving and surviving in 2023.

To that end, here is a round-up of useful news and noteworthy tech tips as we head into the last weeks of the year on what matters most for marketers moving forward.

Fed Communicates Continued Rate Increases

Fed Communicates Continued Rate Increases

Federal Reserve’s Federal Open Market Committee (FOMC) announced interest rate change Nov. 2, and strongly suggests another rate increase at the December session. The Nov. 2 statement by the FOMC, and comments from Fed Chair Powell, make it clear that banks should expect change to be an ongoing constant for the foreseeable future. An excerpt of Chair Jerome Powell’s comments follow:

“At today’s meeting, the committee raised the target range for the federal funds rate by 75 basis points…with today’s action, we have raised interest rates by 3-¾ percentage points this year, we anticipate that ongoing increases in the target range for federal funds rate will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time. Financial conditions have tightened significantly in response to our policy actions, and we are seeing the effects on demand in the most interest-rate sensitive sectors of the economy, such as housing. It will take time, however, for the full effects of monetary restraint to be realized, esp on inflation. That is why we say in our statement that determining the pace of future increases in the target range, we will take into account… At some point, it will become appropriate to slow the pace of increases as we approach the level of interest rates that will be sufficiently restrictive to bring the inflation rate down to our goal. There is significant uncertainty around that level of interest rates. Even so, we still have some ways to go. And incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected.

Our decisions will depend on the totality of incoming data, and their implications for the outlook for economic activity and inflation. We will continue to make our decisions meeting by meeting and communicate our thinking as clearly as possible. We’re taking forceful steps to moderate demand so it comes into better line with supply. Our overarching focus is using our tools to bring inflation back down to our 2% goal…Restoring price stability is essential to set the stage for achieving maximum employment and stable prices in the longer run. The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done. To conclude, we understand that our actions affect communities, families and businesses across the country. Everything we do is in service to our public mission. We at the Fed will do everything we can to achieve our maximum employment and price stability goals.”

Three core benefits of automated disclosure management

- RISK MANAGEMENT, always the TOP PRIORITY for banks. With auditability and traceability provided with automated platform technology, you eliminate risk.

- CUSTOMER EXPERIENCE, a KEY DRIVER for retention and growth. Consistent disclosures across all channels support the needs of customers and regulators.

- SPEED TO MARKET, pivotal to maintaining a competitive edge. Automated rules engine allows the marketing team to scale efficiency and leverage innovation.

Good reads and resources for process improvements

Good reads and resources for process improvements

By now, you likely know that the Naehas team prides itself on building strong relationships, created from productive, proven and results-focused partnerships. So it is not surprising that the team has built a large library of helpful, easily digestible, actionable insight-filled resources.

As we do with our long-standing clients, we’ve pulled some of our most popular pieces off the shelf for you to read, listen to and from which to gain actionable insights:

- “Spotlight on Bank Regulations and Disclosures: Executive Q&A”

- Disclosure Management Infographic

- “Remedies for Rate Change and Risk Reduction as Feds Fight Inflation”

Getting and staying ahead of the complex challenges inherent in bank marketing is easier when you understand the benefits that trusted partners and proven platforms can deliver to meet your enterprise needs. We hope the resources and expertise we’ve provided help you along the way!