An engaging expert panel discussion was held which highlights the essential building blocks for executing personalized offers at scale in the financial services industry. Panelists included:

Christopher Young, Director, Industry Strategy & Marketing, Financial Services, for Adobe. He leads a team of industry specialists who work with Adobe’s financial services clients to help them develop best-in-class digital marketing strategies.

Chandramouli Venkatesan, Senior Director of Market Development for Capgemini Financial Services. Chandra leads the go-to-market for digital marketing services in the Banking and Capital Markets practice at Capgemini.

Rab Govil, CEO and Founder of Naehas, an industry customer experience cloud purposefully built for regulated industries.

The panel focused on digital transformation and the digital customer experience. In this Part 2, the emphasis is on helping martech teams move successfully from siloed to seamless:

Primary pain points

When the process is the problem

The role of change management

Building blocks to scaling offers

Offers Defined

As financial service institutions are increasingly moving toward bundled offers, those who support their efforts reinforce the value of identifying precisely what an offer entails.

An offer is a promise made by a financial services institution to a customer or prospect to provide a service, product, benefit or experience in exchange for their business, and can be contractually binding when accepted. Offers extended by financial institutions are complex, highly regulated, and must be clearly communicated to consumers on channels (brand, direct mail, email, web, etc.) and contain unambiguous terms (disclosures, stipulations).

Acknowledging and Addressing Challenges

What are the primary challenges finserv faces in offer management?

Why is it difficult to put offers together?

How to increase efficiencies and realize better outcomes while shortening the offer lifecycle?

Martech leaders challenged with executing personalized offers at scale need to identify what steps are needed to improve internal processes and expedite time-to-market, all while meeting complex compliance regulations.

The finserv focus: ensuring delivery of a superior customer experience. The reality: the process can create a snag.

Having researched the business models of well over 400 financial technology organizations across the globe, Capgemini’s Vice President of Market Development, Chandra Venkatesan, has observed consistent challenges which help his team deliver insight to solve for and remove those common offer management obstacles.

When executing personalized offers, financial service and wealth management institutions find themselves challenged with multiple obstacles. While the goals are clear, so are the pain points.

Goal: Better Outcomes

Pain Points

Unable to create offers to bundles (multi-product)

Inability to offer relationship-based dynamic pricing

Goal: Higher Efficiency

Pain Points

Disjointed, manual processes lead to long time to market

Error-prone process with long payment cycles (30-45 days)

Goal: Customer Experience

Pain Points

Highly-manual processes with no visibility into the customer status

Extremely slow customer care/customer resolution

When the process is the problem

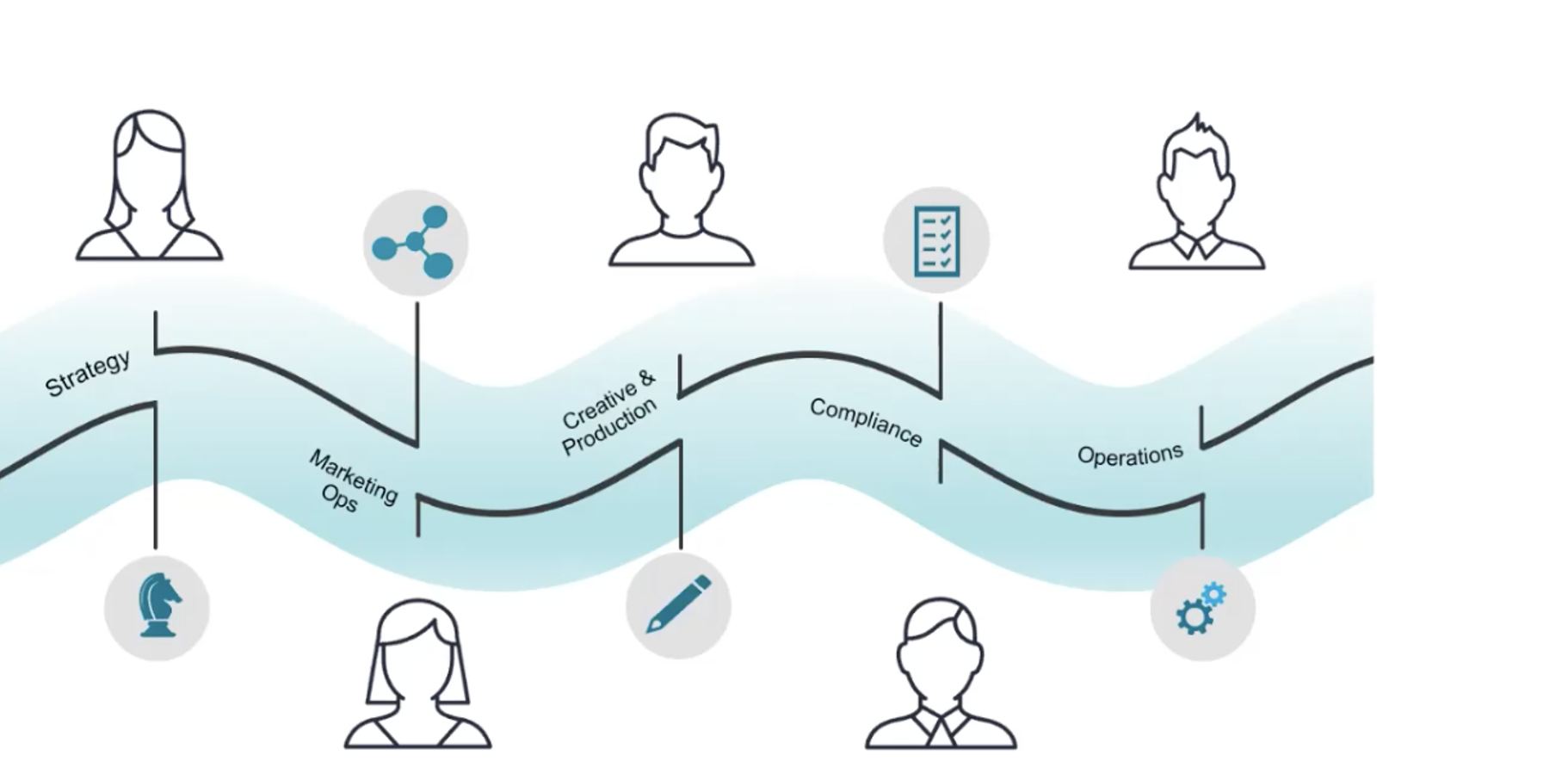

The panel reflected on these pain points, leading to an in-depth discussion on one critical observation they’ve seen across the industry. They all agree that the hardest part of the process is the process. As organizations move toward more personalized experience and offers, the amount of people you need increases exponentially. With so many departments — from offer strategy to creative, operations, compliance and others — needing to be involved, it is often the case that internal operational challenges are weighing them down. This can become a limiting factor when teams do not have manpower to address these important issues. The bottom line: this impacts the institution’s ability to realize outcomes.

“The process becomes the greatest problem. When we look at customer experience, the process can create a snag. That is where it’s about how to increase efficiencies and try to get the best outcome in terms of offer and shortening the offer life cycle, so that we can ensure that overall we deliver a superior experience for the customer.” – Chandra Venkatesan, Vice President of Market Development, Capgemini

A common challenge for martech leaders and their teams: fragmented employee journeys impacting efficiencies and time to market.

Siloed views of the journey, and partial views of the same customer, are additional challenges financial institutions face when executing personalized offers at scale.

Offer Lifecycle: From Siloed to Seamless

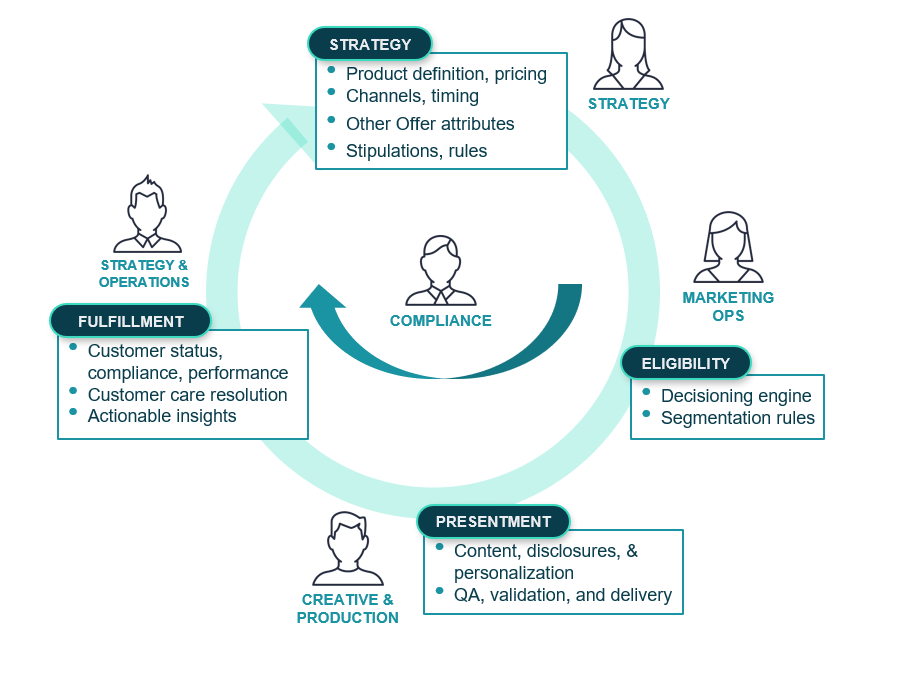

Managing the product through the complete offer life cycle is critical. For martech leaders looking to execute at scale, this calls for enterprise-wide collaboration. Working in partnership with Young and Venkatesan in servicing leading financial service institutions, Govil has seen immense ROI for teams which consider and address the needs of each department. Govil offered these insights:

The Role of Change Management in Offer Management

Financial service institutions face many challenges when transitioning from a siloed workflow to a seamless offer lifecycle.The panelists agree that the biggest challenge is coordination. In establishing greater efficiencies when scaling offers, martech leaders and their counterparts across the enterprise, who previously worked in silos, will need to come together to ensure alignment.

“The change management aspect is fundamental. Much of the decision making comes from a machine, but there is a degree of working together more closely, aligned more on automation, that is important to recognize,” according to Adobe’s Young. He emphasized that any such transition calls on organizational changes and operational models, driven by change management. Young adds, “You cannot take on a technology like ours or Naehas’ and then pretend to use it in the exact same way you are using the historical technology. It is just not going to work.”

Capgemini’s Venkatesan concurs. As he has experienced, the processes of change management are a big component, along with technology. His words serve as a clarion call for finserv and wealth management industry leaders. He urges collaboration. Noted Venkatesan, “We see the failure to implement proper change management is what backfires when we are attempting to work with organizations taking on such large transformations.”

“With any offer, in any institution, there is a high level of complexity that needs to be managed,” notes Govil. He adds, “We recognize that it seems onerous, but once you have a model in place, what you find is that it becomes very easy to execute these types of offers, and that they absolutely create value. It really makes a lot of sense not only for consumers, but for institutions to be able to work together. Win win scenarios are being developed now, and really starting to pay off.”

See how this worked for a Top 10 bank: Naehas Offer Management Solution Drives Relationships and Revenue

Top Priority: Time-to-Market

“The critical point is this: If there is one operational metric we found that you can use, it’s that you should focus on time to market. In the end, speed is THE most important metric you have from an operational cost perspective. Can you put speed in place to do that while maintaining quality? For the financial services industry, you need to increase speed and you need to increase personalization, but you cannot do it at the expense of quality. That is absolutely required. When you are able to do that, the benefits to the consumer and to your organization are substantial.” – Rab Govil, CEO and Founder, Naehas

Building Blocks

Working collaboratively with team members from across the enterprise, martech leaders embarking on executing personalized offers at scale are focused on five building blocks.

Real-time Customer Profiles that incorporate preference, behaviors and contextual data

Select a personalized offer from the Naehas inventory of options at scale

Deliver the right offer through the right channel in context of the customer’s journey

Optimize one or more KPIs (example: user completes conversion step 2)

Logic for offer selection (example: select from ‘premium credit cards’ with ranking model)

Key Components to Scaling Offers

Marcom leaders across the financial services industry consistently and successfully partner with platforms and processes to establish and maintain a competitive edge. Fundamental to the success of offer execution, three components have been identified as critical for marketing technology teams and finserv teams seeking greater outcomes:

- Configurable offer types for more flexible offer strategy

- Seamless review between teams with a compliance assessment powered by AI

- Visibility into customer status for more accurate offer fulfillment

By leveraging these insights, and understanding of the institution’s preparedness, finserv marketers are well-positioned to continue achieving the industry’s fundamental goals.

For a deep dive into this panel discussion, download the ebook HERE or request a demo at www.naehas.com/demo-request