Within financial service institutions, the roles of those in legal, risk and compliance are leading the charge in meeting complex government regulatory guidelines. A range of titles across financial institutions in the United States meets the demands of governance, regulations and compliance: Chief Compliance Officer, Senior Vice President/Vice President of Legal Risk, Governance, Risk & Compliance Director, Regulatory Counsel or Regulatory Compliance Division Leader. These, and others, all answer to the demands of federal and state regulations. The demands of disclosure management call for a laser focus on one core mission: compliance.

No matter the style or size of the institution, whether a Top 10 national bank, community bank, financial services company or new financial technology start-up, the demands are daunting. Further, financial reporting, data security, risk mitigation, in a complex regulatory landscape, make for a most challenging set of functions which must be carried out flawlessly.

What’s most important when managing disclosures? As you’ll see in the case study below, whether for a bank, wealth management firm, fintech start-up or insurance company, there are fundamental goals that must be met when managing disclosures for compliance:

- Risk Mitigation

- Accuracy

- Traceability and Auditability

Success criteria for those responsible for meeting these highly-complex regulatory requirements are many. And the pressures are significant, dealing with security, technology and vendor selection, while handling myriad marketing demands to review and approve collateral material for compliance. Automation addresses these challenges and delivers measurable outcomes. We’ve shared one example in this article.

First and foremost is the importance of avoiding any security breaches. The cost to the enterprise is steep. Problems meeting regulatory guidelines can result in massive fines; professionally, involved in compliance that fails has been known to impact their jobs and their career prospects.

“You have to build an industrial-scale operation just to digest all the regulatory changes.”

– Chief Compliance Officer, HSBC

We also often see that legal and compliance team leaders place importance on avoiding “technology sprawl,” by consolidating a select few vendors. This is particularly challenging, as intense workload, and legacy systems, cause them to struggle under technical debt to keep existing systems up and running, while trying to bring innovation to the enterprise.

At the same time, they are being bombarded by vendors, and having a hard time understanding what is relevant to the bank, and what will meet their needs.

Staying current on regulations and the technology that supports the institution’s compliance efforts is a vexing challenge for risk, legal and compliance teams. Adding to the workload is the necessity of working collaboratively with marketing operations and execution teams on the ever-increasing volume of collateral, marketing offers and segment operations. Ad reviews, regulated content approvals, especially with the fast pace of digital transformation, require time and manpower. Added to the pressures of meeting government regulatory compliance requirements, these individuals are aware of business priorities, as time-to-market and the need to create value for the customer additional objectives impacting their roles.

“We always look for opportunities to produce the best return on our staff investment. Using AI keeps our costs down and strengthens our commitment in raising the bar from a regulatory perspective. Consumer compliance rules are not going to get any less complex, so we have to get more sophisticated in how we ensure compliance with those rules.”

– Sr. VP, Partner Service Delivery, MetaBank

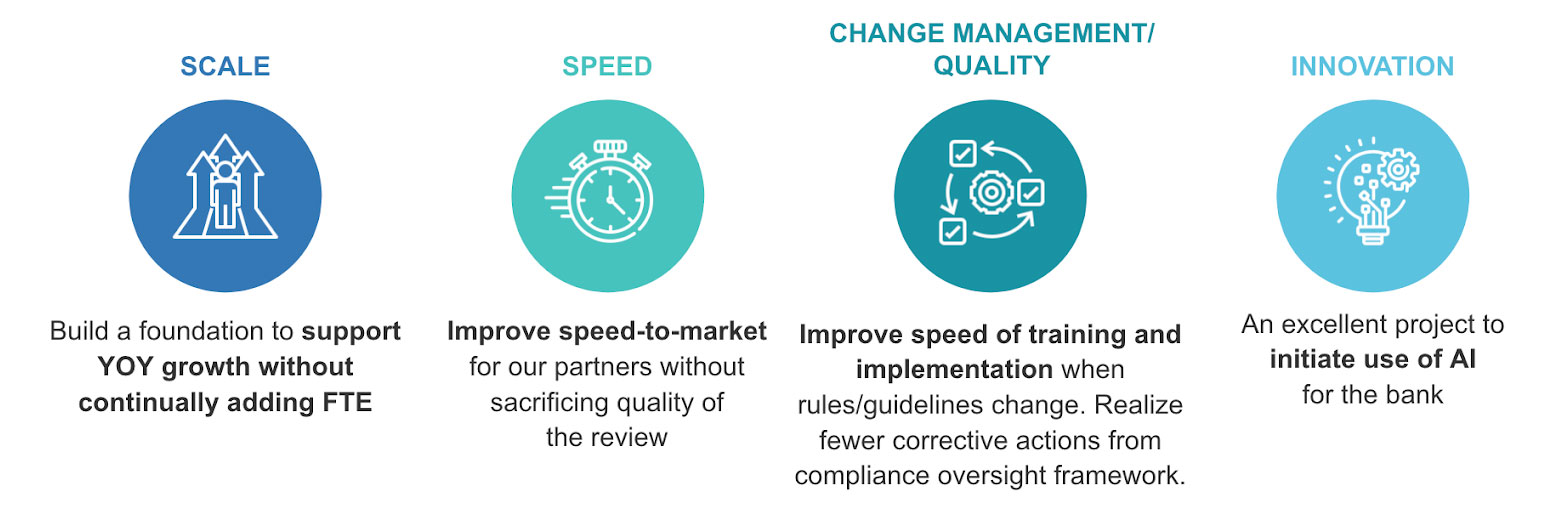

When working on improving their compliance review programs, banks typically share similar goals. Here’s a quick glance at what clients bring to us as we collaborate to meet their needs:

Solving for Compliance

What can be done to alleviate the burdens on those managing compliance? Automation. Delivered with trust and collaboration, automatically creating disclosures delivers significant benefits, chief among them being risk mitigation, and consistency across the enterprise.

Compliance automation offers value in 5 key ways:

- Risk management

- Auditability and Traceability

- Speed-to-Market

- Scale efficiency

- Innovation

Bank marketing teams require a wide range of deliverables from technology partners. It’s vital for their legal, compliance and risk management teams to have confidence and trust in how new technologies advance their work and streamline for better regulatory compliance.

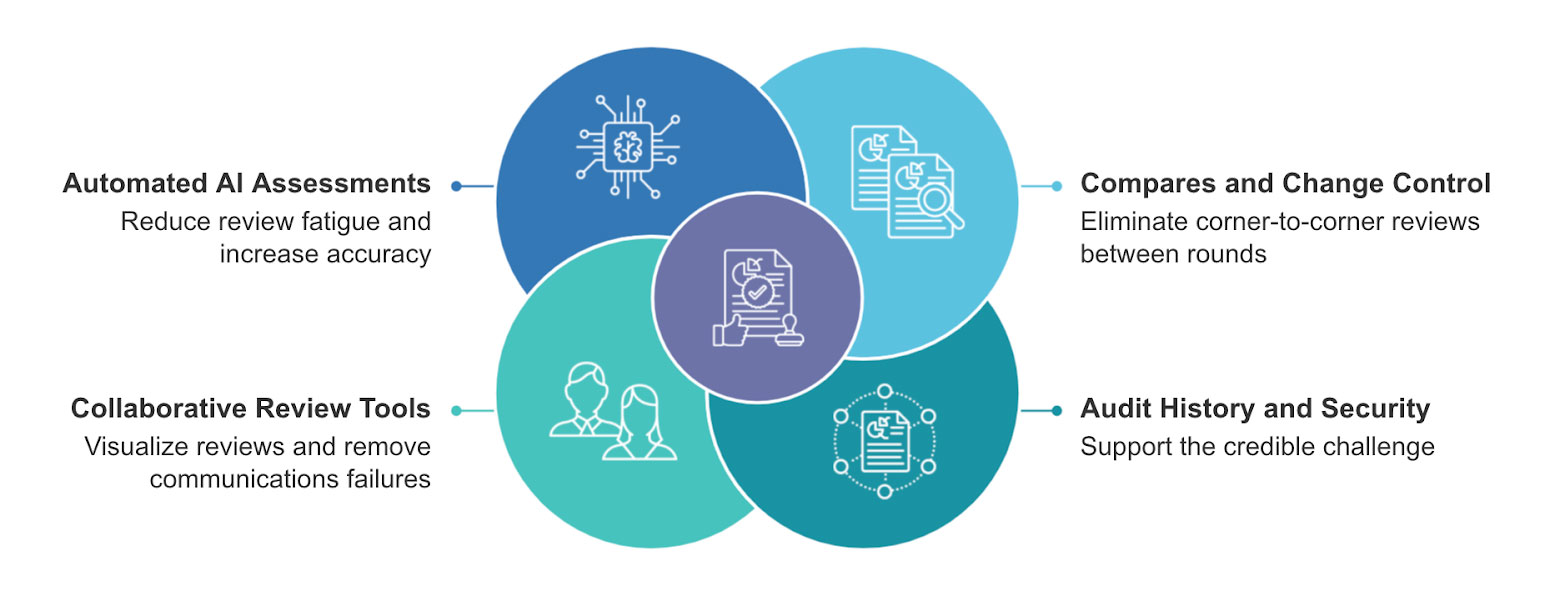

Naehas offers an AI-powered engine for ensuring disclosures and regulated content are accurate, compliant and auditable. Our Disclosure Management solution is a leading industry cloud, purposely-built for industries that must meet complex regulatory compliance, has been leveraged by our financial service clients to automatically create, manage and deliver disclosures for all products and channels.

Here are the components of compliance AI platforms leveraged in bank marketing.

Case Study in Compliance Automation

One of many examples of ways disclosures and marketing compliance helped one major bank institution follows. It is instructive to legal, compliance, risk management and marketing teams striving to meet primary goals of efficiency, acceleration and scale, effective controls, and a compliant client experience.

The core objective was clear:

Create a consistent, efficient disclosures management process, and comply with regulations.

The Challenges:

- Disparate systems, duplicative activities, and inconsistent processes

- Increased regulatory and business expectations

- Long cycle times due to highly manual intensive process

- Process was deemed as high risk, as quality control processes were manual

- Increased volume due to more channels and hyper personalization

The Solutions:

- In-depth current state assessment

- Benchmark against industry-wide clients of different sizes

- Future state service blueprint for optimizing Disclosure Management

- Disclosures and content management user journeys and persona’s development

- based on the governance models

- Simplify and automate workflows for creation and compliance of all disclosures.

The Results:

- 96% redu

ction in cycle time for simple changes

ction in cycle time for simple changes - 60% cycle time reduction for medium to compliance

- 100% reduction for self-reported errors

Clearly, the benefits – streamlined, accurate and auditable compliance, exceeded the need. With so many demands on legal, compliance, risk and marketing managers in financial services, amidst a heavier-than-ever workload in an increasingly complex regulatory landscape, automation answers the call.