Are the recent and anticipated rate changes by the Federal Reserve keeping you up at night?

While they may not have been much of a surprise, the multiple rate increases announced by the Fed Reserve continue to flummox financial institutions. It’s clear to see why. This article is written specifically to show just how the process of comparing docs across channels, and ensuring changes are made without errors, can be done in minutes, not weeks or months.

The myriad marketing and disclosure management To-Dos that mid-level bank teams are faced with are daunting. Now more than ever. Managing risk, reducing errors and creating exceptional customer experiences are all, and always, top priorities.

Multiple Prime Rate changes are not helping.

Adding to the woes are the increased volume and the breakneck speed at which omnichannel offers are being coordinated – across marketing, compliance, risk management and product/line of business owners – amid the industry’s digital transformation.

Comparison Tool Solves Top Bank Marketer Challenges: A Tech Tutorial

There’s good news. And it comes in the way of automation. As we know that our readers are some of the busiest people in the financial services industry, we’ll make this one quick. We’re adding a visual “tech tutorial” to help you and your teams see just how simple – and fast! – the process of proofing regulated content can be.

The team asked me to create a quick-view summary on the Naehas Comparison Tool. As it’s common for me to work – typically on screen – with clients to collaborate on how to optimize our solutions, this was an easy task for me. My goal: make the task of reducing errors with regulated content easy for you.

What does a Comparison Tool do, exactly? It assists marketers in reviewing and validating quality control and change management between versions of a piece of marketing collateral.

When and where is a Comparison Tool used? Anywhere you come across regulated content. With the myriad, and often complex, marketing musts we know teams contend with daily, it is important to know the multiple applications, and how they expedite internal processes.

The Comparison Tool is used by bank marketing, risk management, product line owners and compliance managers to validate:

- Change Management

- Auditing

- Quality Control

To illustrate the point, here’s a useful short segment that bank marketing, compliance, risk and product teams can review to resolve the common pain points that are being felt across the industry as a result of the Federal Open Market Committee (FOMC) rate changes. Note that there are still several meetings left in 2022. No time to lose.

In this example, I demonstrated how a change to a Prime Rate – which affects the variable APR, and occurs in disclosures throughout marketing collateral – is impacted by Federal Reserve rate changes. And how this tool covers all of the bases for comparing content changes.

Learning how to leverage Comparison Tool technology delivers important benefits:

- Reduces manual errors

- Eliminate risk by improving compliance

- Dramatically cut cycle time on rate changes for all regulated content

It’s why Naehas purposely built the technology for companies operating in highly-regulated industries.

Risk Management 101

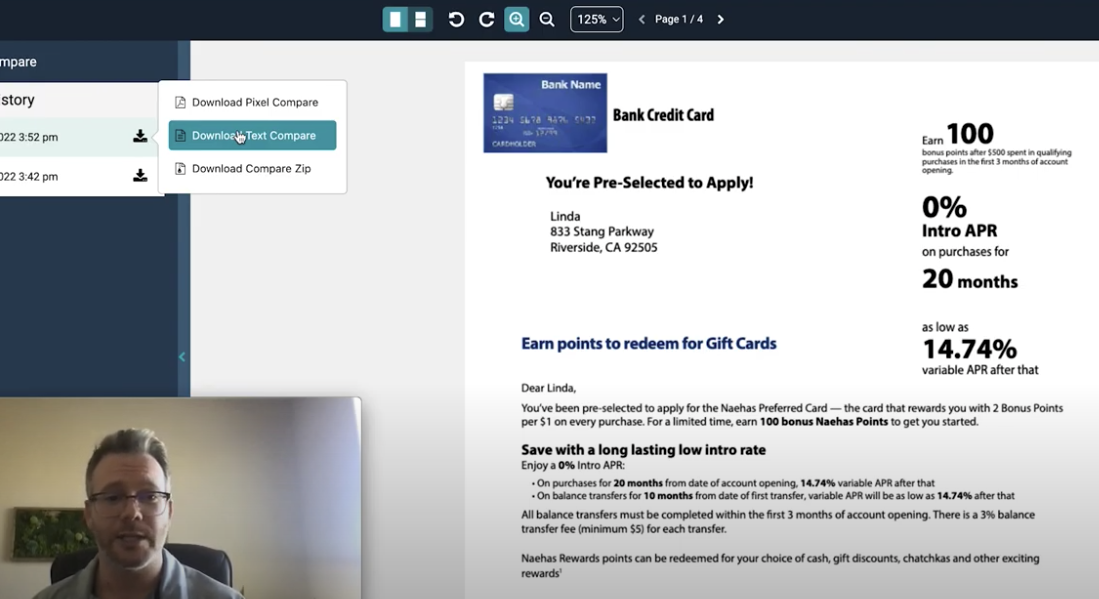

We need a way to ensure that the change that was requested was the only change made, and we do not have any unintended changes, like new artwork or old disclosure language. Using the Naehas Comparison Tool, you can either upload a doc directly, or compare docs that are already in the system. And it’s as simple as running a new compare. The Comparison Tool will compare the file in two different ways.

First, there is a visual comparison which will actually give you a pixel output and highlight any changes. And there is also a text comparison, which compares the docs at a text level. And, if you are using an HTML format, it will review it also at the source code. So it is important to be able to have all these different tools at your disposal to easily validate them. And these compares, which run in a matter of seconds, across hundreds of pages, can reduce the amount of time it takes to validate files. I know it is very easy for something to slip through the cracks when you are reviewing a disclosure that may be 80- pages long, or when you are reviewing artwork that might have shifted into a no print zone. Using this tool, all of these changes will be captured and brought to our attention to validate whether or not that change is expected.

First, there is a visual comparison which will actually give you a pixel output and highlight any changes. And there is also a text comparison, which compares the docs at a text level. And, if you are using an HTML format, it will review it also at the source code. So it is important to be able to have all these different tools at your disposal to easily validate them. And these compares, which run in a matter of seconds, across hundreds of pages, can reduce the amount of time it takes to validate files. I know it is very easy for something to slip through the cracks when you are reviewing a disclosure that may be 80- pages long, or when you are reviewing artwork that might have shifted into a no print zone. Using this tool, all of these changes will be captured and brought to our attention to validate whether or not that change is expected.

So we are going to walk through that prime rate change, where we requested a new variable APR. Now we have the new version we received back (new APR as seen on screen). After we run the comparison, and keep in mind, all comparisons that are run in the Naehas platform are stored here, allowing complete auditability and traceability to go back and see exactly when this was run, and access those results.

Now for the text comparison. Taking a look at two documents shows the first version of the document, on the left, and on the right hand side the new percentage rate. Any changes that take place between these documents are highlighted (red – indicating it was removed) and green (indicating it was added).

To answer questions we typically field from bank marketers and credit card issuers, we’ve developed other useful segments. Why? To bring executives on board with a greater understanding of the significant benefits automation delivers.

Rate Change Realities and Tech Solutions

The complexities inherent in disclosure management, regulated content reviews and the fast pace of digital transformation today require smart solutions that cut time and reduce risk.

What once took a bank 4-6 weeks can now be done within minutes.

Where error-prone manual processes once wreaked havoc on risk management efforts, the technology now does the work, reduces errors and saves time.

Looking at this document in the HTML comparison tool, we can actually look at the source code in those two different files. Any of those differences are highly to quickly navigate and jump between the different sections where those changes occur. Finally, that visual comparison, our text comparison, will perform the same function. On the left is the original document, and on the right is the updated version of the creative, and in the middle, everything in grey indicates no difference, and anything in red or green indicates a change. I can quickly see that my blue credit card is no longer blue and in fact,has actually shifted into a no print zone. Or perhaps there is different disclosure copy that is being used when it should not. When you are going through something at the last minute like a prime rate change, you are up against a tight deadline already.

Having these tools to be able to quickly validate and run quality control between the rounds saves the team time, reduces the amount of cycle time it takes for review, so you can actually review more documents, as well as takes away the human error element. As mentioned, those long documents can be very cumbersome and it is easy to make mistakes and have things slip through the cracks. Using the Naehas Comparison Tool, we help by putting guardrails in places to ensure that does not happen.

Having these tools to be able to quickly validate and run quality control between the rounds saves the team time, reduces the amount of cycle time it takes for review, so you can actually review more documents, as well as takes away the human error element. As mentioned, those long documents can be very cumbersome and it is easy to make mistakes and have things slip through the cracks. Using the Naehas Comparison Tool, we help by putting guardrails in places to ensure that does not happen.

If you are like most other bank marketing professionals flummoxed by the changing rates, and wondering how to navigate the rough waters ahead (FOMC meets again in September, November and December), don’t miss out on the Naehas Resource Center. You’ll find a range of materials to support ways to reduce risk, expedite time to market and create exceptional customer experiences in answer to the fast-changing market conditions.

There is no time to lose when looking to leverage technology tools to meet a bank’s needs. And there is definitely no time to lose in communicating with customers – existing and potential – to establish exceptional customer experiences on your products.