An engaging expert panel discussion was held which highlights the essential building blocks for executing personalized offers at scale in the financial services industry. The high-level discussion featured insights and solutions shared by the following industry professionals:

Christopher Young, Director, Industry Strategy & Marketing, Financial Services, for Adobe. Christopher leads a team of industry specialists who work with Adobe’s financial services clients to help them develop best-in-class digital marketing strategies.

Chandramouli Venkatesan, Vice President of Market Development for Capgemini Financial Services. Chandra leads the go-to-market for digital marketing services in the Banking and Capital Markets practice at Capgemini.

Rab Govil, CEO and Founder of Naehas, an industry customer experience cloud purposefully built for regulated industries.

Focused on digital transformation and the digital customer experience, the panel discussed:

- Current drivers in the financial services market, and actionable insights

- Adobe’s 2021 Survey: “The State of Digital Transformation in Financial Services” findings

- Identification of requirements finserv leaders must meet for successful offer management

What’s Driving the Finserv Market Today?

Taking the pulse of the industry, and understanding its purpose is important in an ever-changing world. What is the finserv industry trying to do? What investments should be made?

“The purpose of the industry is improving the financial health and wellbeing of the customer through meaningful digital interactions. The onus is to help the consumer make smarter decisions about their money, and to help them with meaningful outcomes.” – Christopher Young,

Adobe

Platform Partners Offer A Positive Outlook

Armed with the latest in CX, DX, AI and IT, partners committed to servicing financial service martech teams work to identify and address the challenges met when executing offers to scale. As trusted consultants to leading global and national institutions, these industry thought leaders — customer experience specialists, digital transformation experts, software startup innovators — offer guidance, processes, perspective and experience which, together, serve as a powerful marketing force multiplier.

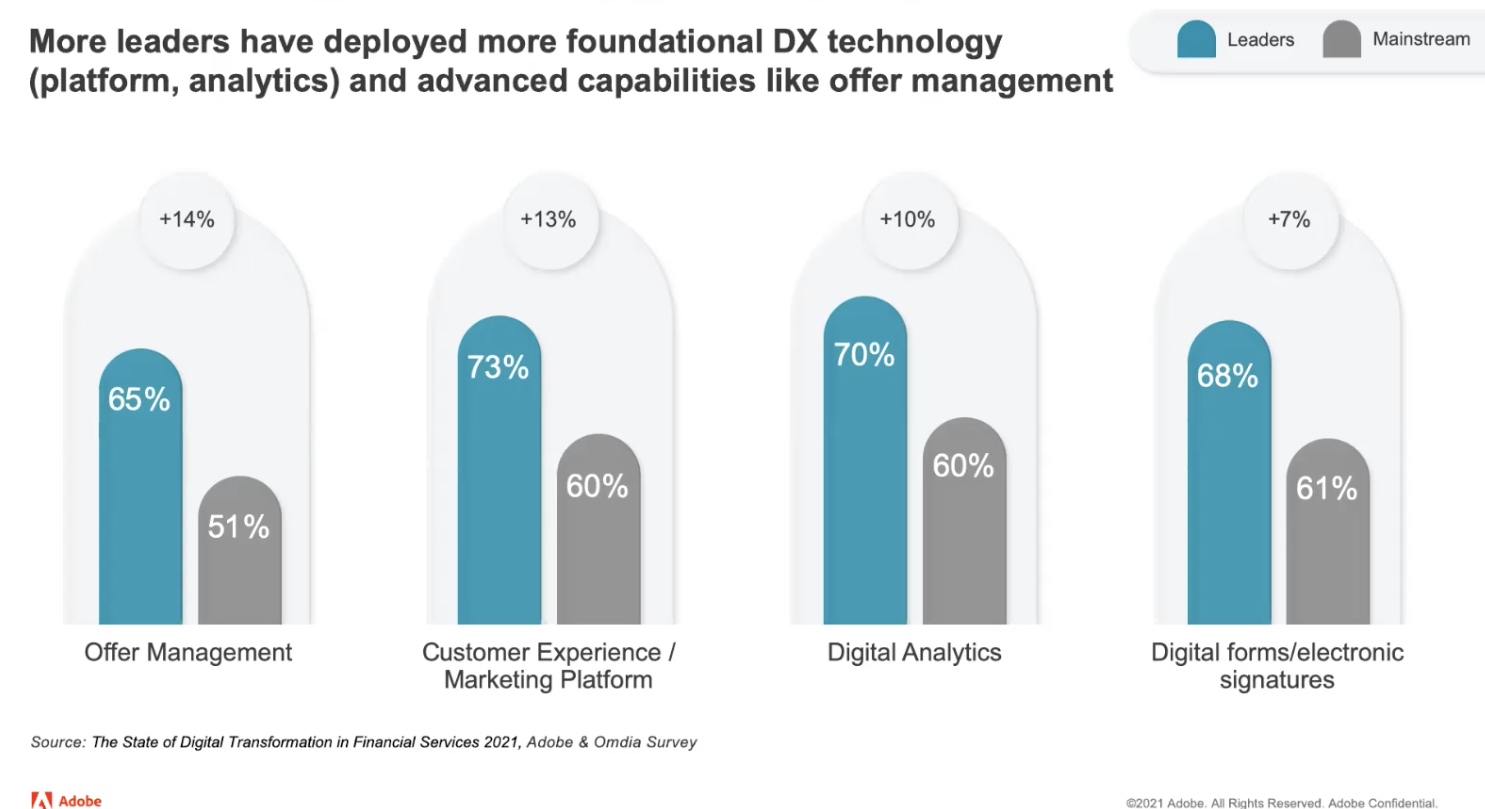

Govil, Young and Venkatesan are finding that more leaders have developed more fundamental DX technology (platforms, analytics) and advanced capabilities like offer management. Realizing its significance, and being effective in this space will help financial services and wealth management institutions get into a valuable leadership position.

Good news: the industry is making progress in omnichannel customer engagement. Executing personalized offers at scale demands focused attention and collaboration across the enterprise, as one thing is clear: offers get very complex and are highly regulated.

While onerous, once a model is put in place, it becomes easy to create value. This is why there are more bundled packages really starting to pay off, according to Govil. Young and Venkatesan have also observed this first-hand. As organizations move to bundled offers, they are successfully distinguishing themselves from the rest of the market.

The Industry Speaks: “Adobe’s 2021 Digital Trends Report”

To better understand the industry, Adobe conducted its annual survey that charts the evolution of marketing, advertising, ecommerce, creative and technology professionals around the world.

The Report is based on an online survey fielded to select Adobe and Econsultancy lists in the fourth quarter of 2020. The Digital Trends 11th Edition survey closed having collected 744 qualified responses from the Financial Services and Insurance (FSI) sector.

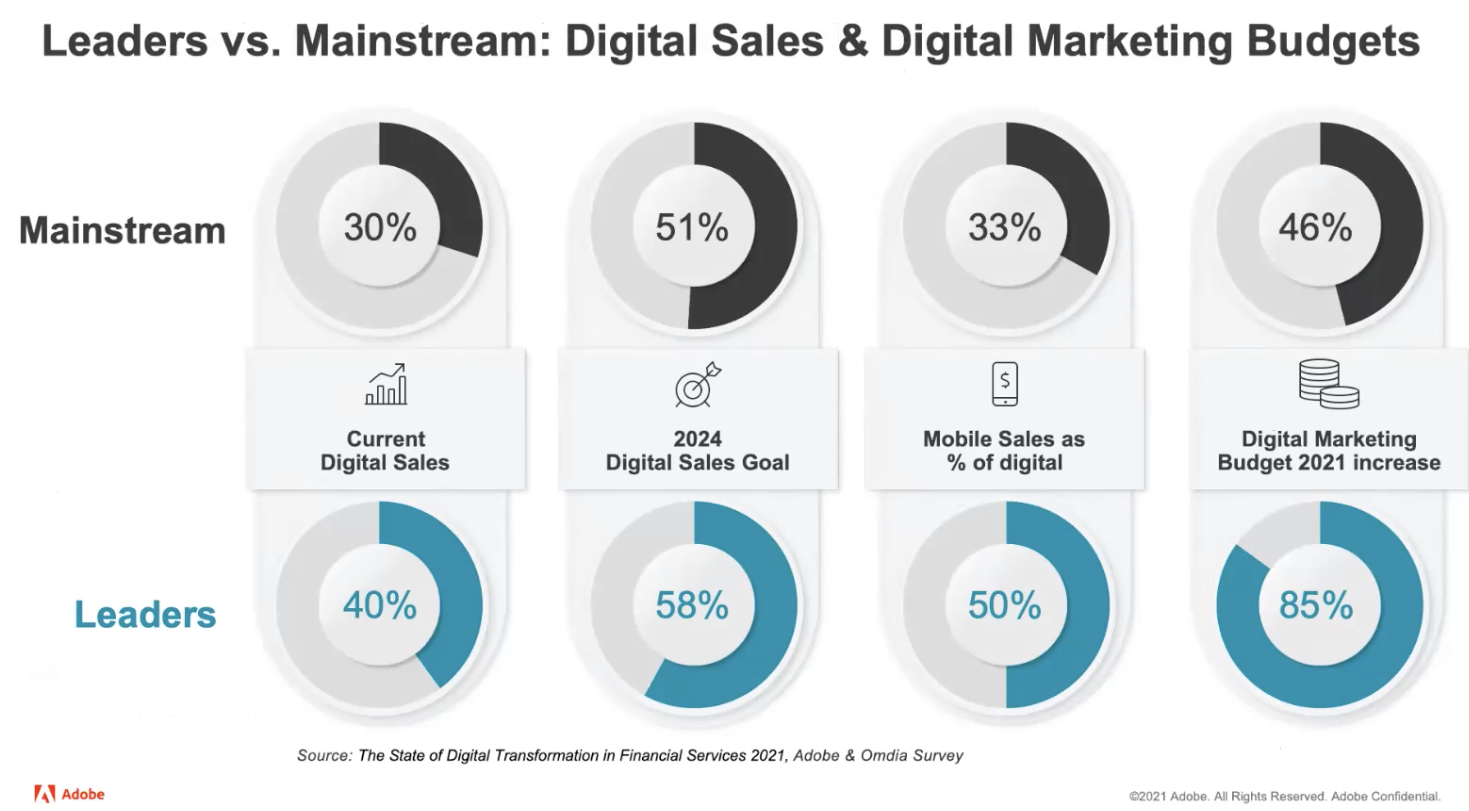

In the panel discussion, Adobe’s Christopher Young shared highlights of the findings of Adobe’s latest report: 2021 Digital Trends: Financial Services & Insurance in Focus. He offered resourceful insights into how industry leaders are executing on offers. A key focus was placed on distinctions between the offer management processes of leaders versus mainstream institutions.

The feedback identifies those who are leading the way in three noteworthy areas:

- Advanced strategies of digital deployment across the journey

- Internal competencies that support the technology which powers those digital experiences

- Focus on customer experience as a priority

Actionable Insights

The Report’s analysis offers finserv marketers essential guidance, by:

Identifying common challenges finserv teams face across the enterprise with their offer management programs

Encouraging marketing leaders to tune into the ways to significantly enhance offer management, for both the teams across the enterprise, and, importantly, for the customer

Learning how other financial service and wealth management organizations rate their own preparedness and operations

Drawing distinctions between institutions which are ‘leaders’ versus ‘mainstream’ marketers

Analyzing and understanding those offer management components that make the difference

Feedback from survey participants serves as fresh intel from and for those involved in offer management. The Report covered goals, challenges, self-ratings on omnichannel customer engagement, and forecasting of future investments in advanced offer management capabilities.

Above all else, respondents signaled that the top organizational goal is to improve the financial health and wellbeing of the customer. Expediting time-to-market and modernizing experiences are other notable goals for financial service institutions, findings reveal.

49% Meaningful digital interactions to improve financial health

35% Faster time-to-market with new products and services

30% Modernizing experience to attract younger customers

28% Selling more online to compete with digital entrants

27% Deflecting from traditional service channels to reduce costs

Making Progress with Omnichannel Customer Engagement

The Adobe Report found that in rating enterprise-wide digital, omnichannel customer engagement, 25% of responders indicated they were leading. This marked an increase from 22% last year. The majority of leaders are in advanced stages of digital deployment across the customer journey, they have internal competencies to drive transformation, and CX is a priority. Additionally, 51% of responders self-reported themselves as “Proficient/Advanced,” while 23% self-rated as “Early Stages/In Progress.”

When forecasting the market’s move toward executing offers at scale, industry observers note that as finserv leaders see the positive impact on the enterprise, they are investing more.

More leaders have deployed more foundational DX technology (platform, analytics) and advanced capabilities like offer management, the Adobe Report found.

For a deep dive into this panel discussion, download the ebook HERE or watch the free on-demand webinar, “How to Execute Personalized Offers at Scale in Financial Services”